Disclaimer

The content shared here is for informational purposes only and reflects my personal experiences. It is not financial advice or an endorsement of any financial services. I am not a licensed financial advisor and do not provide personalised financial advice. Always seek professional guidance before making financial decisions.

Author’s Note

This post is Part 2 of the ‘My Real Estate Journey’ series, where I build on what we covered in Part 1—acquiring our first investment property. If you haven’t read it yet, I recommend checking it out for the full backstory.

In this post, I’ll cover:

- How we decided on our investment strategy

- Key property investing concepts: positive vs negative gearing & the property spiral

- The buying process using a buyer’s agent

- The numbers on investment properties #1 and #2

- A sneak peek at where our journey took us next

Recap of Investment Property #1

In the last post, we left off at our first investment property, a 4-bedroom, 2-bathroom house in Perth, WA that turned out to be a game-changer:

- Revalued at $80K above purchase price within 3 months of settlement

- Sold off-market in just 3 days for $583K, 3 years after purchase

This property set the foundation for our next investment move. But before diving in the numbers further, and into property #2, let’s break down the steps it took to get here.

How We Decided on Our Investment Strategy

I’ve been obsessed with building a property portfolio for a long time. One of the pivotal moments came in 2016 when I was working as a bank teller. A customer came in with a business name that caught my attention – “Invest for Freedom.”

The phrase stuck with me, and as he spoke with energy and enthusiasm about property being one of the most powerful tools for financial independence, I was hooked. That conversation sparked a deeper curiosity, setting me on a path of relentless learning and action.

My First Open Home & Missed Opportunity

That same weekend, I took my partner to visit some opens homes in Sunbury, VIC, where I was working at the time. We saw a 600m2 block listed at $270K – a run-down but mostly structurally solid 3-4 bedroom house. My reaction?

“This place is a shit hole!”

We thought nothing of it and went down the road to grab some burgers. I still think about this missed opportunity from time to time. The property would easily be between 2-3X in value right now.

Lesson learned: You don’t need a perfect property. You need a profitable one.

If I could go back in time and slap some sense into my 21 year old self, I would. But I was a 21 year old student who was working part-time and just didn’t know enough yet. The passion for property investing had only just begun and would grow in intensity over the years.

Since that moment, I immersed myself in self-education – reading books, listening to podcasts, and talking to experienced investors. I consumed literally everything I could. I was determined to crack the code on what to do, where to start, and how to begin. I absorbed information relentlessly: on commutes to and from work, during workouts at the gym, when I was going for long walks during COVID lockdowns, every chance that I got to expand my knowledge further I took it.

Two fundamental investment concepts stood out to me:

- Positively vs Negatively Geared Properties

- The Property Spiral (Steve McKnight’s Framework)

Positively Geared vs Negatively Geared Property: Explained

One of the key decisions an investor makes is whether to pursue positive or negative gearing.

What’s a Positively Geared Property?

A positively geared property (also known as cash-flow positive) earns more rental income than expenses, meaning it generates a profit each month.

Example:

- Rental income: $2,500/month

- Mortgage, rates, maintenance: $2,000/month

- Cash flow: +$500/month

What is a Negatively Geared Property?

A negatively geared property costs more to own than it earns, creating a monthly loss. Investors hope for capital growth to offset the short-to-medium term losses.

Example:

- Rental income: $2,000/month

- Mortgage, rates, maintenance: $2,500/month

- Cash flow: -$500/month

Negative Gearing in Australia 🇦🇺

In Australia, investors are able to deduct rental losses against taxable income.

Example:

- Rental loss: -$6,000/year

- Taxable income: $100,000

- New taxable income (after deduction): $94,000

- Lower taxable income = lower tax bill

Whilst this provides some benefits in reducing overall tax, you’re still operating at a loss so it’s crucial that the property grows in value for you to realise gains later on – otherwise, you’re just purely running at a loss.

Looking at Rental Yield in Residential Property

In residential property, when people refer to yield, they are often expressing this in gross terms. Gross Rental Yield is a simple way to measure a property’s annual rental income as a percentage of it’s purchase price. It helps investors compare potential returns across different properties.

Example:

- Property price: $500,000

- Weekly rent: $500

- Annual rent: $500 x 52 = $26,000

- Gross Rental Yield: (26,000 ÷ 500,000 x 100 = 5.2%)

Why is Gross Rental Yield important?

- Quickly compare investment properties

- Higher yields suggest better cash flow potential

- Lower yields may indicate reliance on capital growth for returns

Note: Gross yield doesn’t include expenses (interest expense, maintenance, property management fees, etc.), so investors also consider net rental yield for a clearer financial picture.

Understanding all of the above, the key takeaway is that negative gearing can be useful in high-growth markets, but a cash flow strategy ensures long-term sustainability. This takes us to key investment concept number 2: The Property Spiral.

The Outward vs Inward Property Spiral

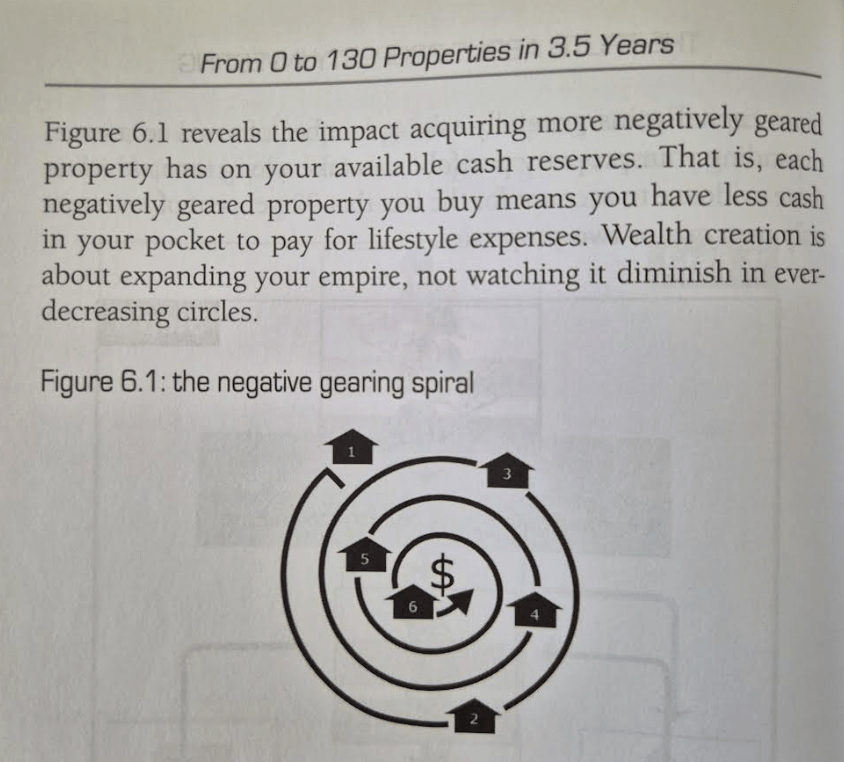

Steve McKnight, a well-known property investor and author, introduced the concept of the Property Spiral in his book From 0 to 130 Properties in 3.5 Years. His model explains how property investors either accelerate their financial growth (Outward Spiral) or trap themselves in financial struggle (Inward Spiral) – based on their investment decisions.

The Outward Property Spiral (Wealth Acceleration)

✅ Invests in cash-flow positive properties

✅ Uses surplus rental income to reinvest & pay down debt

✅ Expands portfolio without relying solely on salary

✅ Increases financial security over time

With this approach, because your properties are positive cash flow and are high growth, with each purchase you move one step closer towards the next investment. In other words, each property adds incremental gains, compounding your portfolio’s growth over time.

The Inward Financial Spiral (Financial Trap)

❌ Relies on negatively geared properties with monthly losses

❌ Depends on salary to cover property shortfalls

❌ Mortgage stress worsens with rising interest rates

❌ May be forced to sell assets at a loss

This approach heavily depends on your personal income to scale, as each property you acquire reduces your overall cash flow. Eventually, you’ll reach a point where your cash flow constraints limit your ability to fund further acquisitions, creating a bottleneck in your investment growth.

This is a valuable framework for property investors. The key lesson is if your property portfolio is financial draining instead of growing, you’re spiralling in the wrong direction.

The goal is to build a portfolio that funds it self and works for you – not the other way around.

In reality, investors can adopt a balanced strategy of both positively and negatively geared properties to mitigate risk. However, when leveraging negative gearing, it’s crucial to be confident in the property’s long-term growth potential and maintain a strong cash flow buffer to absorb potential losses, especially as interest rates fluctuate.

Our Decision

With the above two concepts in mind, it was clear to us that to adopt an outward spiral strategy, we needed to invest in properties that:

- Were neutrally or positively geared (more common at the time with the extremely low interest rate environment)

- Had strong short-to-medium term growth potential

This approach would allow us to scale our portfolio sustainably while minimising financial strain and maximising future opportunities.

But where to begin? At that point in time, I believe I would’ve been among the top 1% of listeners to podcasts such as Australian Property Investors, and that’s where I came across the idea of a Buyer’s Agent.

What is a Buyer’s Agent?

A Buyer’s Agent (also known as a Buyer’s Advocate) is a real estate professional who works exclusively for property buyers to help them find, evaluate, and negotiate the best property deals. Unlike real estate agents who represent sellers, a buyer’s agent protects the buyer’s interests throughout the purchasing process.

What Does a Buyer’s Agent Do & Why Use One?

Here’s what a buyer’s agent does and why working with one can be a game-changer:

✅ Property Search & Market Research – They find properties that meet your criteria, often accessing off-market deals that aren’t publicly listed. They analyse market trends, assess property values, and conduct due diligence to ensure you’re making an informed purchase.

✅ Negotiation & Bidding – Buyer’s agents handle price negotiations and auctions, using their expertise to secure the best possible deal. They know how to spot overpriced properties to prevent you from overpaying and often source deals that are under market value too.

✅ Investment Strategy Guidance – For investors, they align the purchase with long-term financial goals, ensuring strong rental yields and growth potential.

✅ Time-Saving & Stress Reduction – Searching, inspecting, and negotiating require extensive time and effort. A buyer’s agent does the heavy lifting, filtering out bad deals and presenting only high-quality opportunities.

✅ Removing Emotion from Buying – Property purchases, especially for owner-occupiers, can be emotional. A buyer’s agent brings a data-driven approach, ensuring decisions are based on logic rather than emotions.

Whilst there are many reasons why it may be advantageous to use a buyer’s agent, for us, two key factors were important to de-risk our investment:

- Buying Below Market Value: This ensured that we “walked into the deal” with instant equity as a buffer. Securing a property below market value meant we had built-in equity from day one.

- Ensuring Tight Vacancy Rates: A low vacancy rate minimized the risk of the property sitting untenanted. This was crucial in protecting our cash flow, as it reduced the likelihood of having to cover mortgage payments entirely out of pocket.

While it’s possible to do all of this yourself, the amount of time and expertise required is significant. Working with a buyer’s agent provides market insights, negotiation power, and access to off-market properties, ultimately saving you time, money, and stress.

How Much Does a Buyer’s Agent Cost?

Buyer’s agents typically charge in two ways:

- Fixed Fee: A set amount ($X,000) depending on service level.

- Percentage of Purchase Price: Usually 1-3% of the property price.

While this might seem like a significant upfront cost, a good buyer’s agent can save buyers tens of thousands by securing a better deal. In our personal experience, using a good buyers agent has had more than a 5-7X ROI each time.

Whilst there are many great buyer’s agents out there, we ended up choosing Australian Property Scout. Sam Gordon’s background and story just really resonated with me, and the idea of amassing a huge property portfolio on an ordinary income was inspiring.

Disclaimer: This is not a sponsored post. I do not receive any financial gain or compensation from mentioning these services, companies, or individuals. Everything shared here is based on my personal experiences and opinions.

The Numbers

Investment Property #1

📍 Leda, WA

🏡 4-bedroom, 1-bathroom, 607m² block

The Numbers

- Purchase Price: $307,000 (estimated $30K below market value)

- Gross Rental Yield: 6.1%

- Vacancy Rate: 0.1%

- Loan Amount at 90% LVR: $276,000

- Total Funds Required: ~$55,000

Equity Uplift

- Revalued: $380,000 just three months post settlement, enabling us to extract ~$66,000 worth of equity for the next property purchase

- Sold: $583,000 after holding the property from 2021 to 2024

Investment Property #2

📍 Frenchville, QLD

🏡 4-bedroom, 1-bathroom, 607m² block

The Numbers

- Purchase Price: $325,000 (estimated $25K below market value)

- Gross Rental Yield: 6.7%

- Vacancy Rate: 0.4%

- Loan Amount at 90% LVR: $276,000

- Total Funds Required: ~$55,000

Equity Uplift

- Revalued: $430,000 on settlement day! Enabling us to extract ~$80,000 worth of equity for the next investment

Reflections

I hope this highlights that property investing doesn’t require an extraordinary income or massive savings to begin. You can start small and gradually grow your portfolio over time. The first deposit will always be the hardest—it’s all about disciplined saving and budgeting. Unlike a primary place of residence (PPOR), investment properties don’t qualify for parental or family guarantees, so the initial hurdle is purely on you. But once you’ve started, it gets much easier.

Key Factors That Led to Success:

📚 Education & Knowledge – “Formal education will make you a living; self-education will make you a fortune.” – Jim Rohn. With so many free resources available, there’s never been an easier time to gain the knowledge needed to invest wisely.

👥 The Right Team – Surrounding ourselves with the right people was crucial. A knowledgeable buyer’s agent, a lender who understood our strategy, and a solid accountant made all the difference.

💡 An Investment Mindset – Property investing should be treated like any other asset class. A common mistake is wanting to invest in something familiar—like a property nearby that you can “see and touch.” But that’s irrelevant. You wouldn’t visit a company’s headquarters before buying its stock. The same applies to property—the numbers matter most. That’s why we’ve never physically seen either of these two investment properties.

What’s Next?

Our original plan was to continue acquiring investment properties, eventually transitioning into commercial real estate for higher cash flow and exploring property development. However, a significant increase in income created new opportunities, and lifestyle changes led us to take a slight detour.

In the next post, I’ll share:

- How we used our funds to invest in a joint venture property development project

- Why we temporarily paused investing to buy and renovate a family home

- Where we’re headed next in 2025 as we refocus on growing our portfolio

Thank you for reading. If you’re considering starting your property investment journey, I hope this series provides you with insight and inspiration. My goal isn’t to flex our portfolio—it is modest and it’s my intention to show that breaking into the market is far more possible than the narrative in Australian property news often suggests.

Stay tuned for part 3!