Disclaimer

The content shared here is for informational purposes only and reflects my personal experiences. It is not financial advice or an endorsement of any financial services. I am not a licensed financial advisor and do not provide personalised financial advice. Always seek professional guidance before making financial decisions.

Author’s Note

This blog series is going to dive into my personal real estate journey – how my partner and I went from buying our first home to scaling our portfolio to multiple properties, and eventually getting to the point where we could buy and renovate our dream home in a suburb we’d always wanted to live in. I’ll keep updating this series as we make new acquisitions and refine our strategy along the way.

Our property portfolio isn’t massive, and we still have a lot to learn and build – but it’s far from insignificant, and we’re making steady progress. I felt compelled to share our experiences because the dominant narrative in Australian property news today makes it seem that breaking into the market is ‘impossible’ for millennials.

I get it. It’s hard. In fact, I’m not sure it’s easy to get into the property market anywhere in the world when you’re starting from scratch. But let’s be real – it’s even tougher here in Australia. Cities like Melbourne and Sydney are ranked 2nd and 7th globally for housing prices as multiples of earnings (according to this Australian Financial Review article).

Whether you’re a millennial or first-time buyer, I know the challenges are real and it can feel like the odds are stacked against you. But here’s the thing: it’s not impossible. I’m not here to tell you it’s easy, or that I have all the answers, but it is definitely achievable. The journey of a thousand miles begins with a single step.

First Off, Is Owning Your Own Home Even the Right Move?

When my partner and I decided to enter the property market and look for a home to live in, the first question we asked ourselves was: why?

Several factors came into play:

- What are our long term financial goals? Sometimes rentvesting is actually the best strategy as it doesn’t tie up your borrowing capacity/serviceability

- Are we just buying into the Australian Dream without questioning whether renting is a potentially better option?

- Where do we want to live and can we afford something in that area? If not, what compromises are we willing to make?

- How long do we want to stay?If we’re just testing the waters of living together and the area, does it make sense to enter a long-term financial commitment?

We were both 24 years old when we decided that we were ready to buy our first home. It was a necessity to move out because my partner was struggling at home and it was also a step that we felt we needed to take for our relationship. At that point in life, I was so focused on establishing my career that it left no time for our relationship. Moving in together meant we could at least share those in-between moments.

Buying was also feasible because we were willing to compromise to stay within our means, whether that meant buying an apartment or a smaller townhouse, as long as we were relatively close to our friends and family. Truthfully, buying our first home was also a milestone that I just really wanted to achieve.

Your First Home Is Not Your Forever Home

When was the last time you stopped to ask yourself what your dream home truly looks like? Many imagine a house close to the CBD with ample space and a large backyard, or perhaps a place right by the beach. Applying these filters to a quick real estate search, however, you’ll notice that prices quickly jump into the millions.

For most people, that dream home isn’t financially realistic as a first step. However, if owning your own home is important to you, having a clear vision of your forever home is crucial. Knowing where you want to go is the first step in charting a path to get there.

A Quick Visualization Exercise: Take a moment to imagine your dream home in detail. Where is it located? How many bedrooms does it have? What kind of architectural style do you prefer? How will you design and decorate the interior? What will your daily life look like there? How will you host friends and family? Getting specific about these details can provide clarity and motivation for your journey.

I believe owning your own home is much like any other long-term endeavour. In sports, you start at the bottom and train your way to the top. In your career, you begin in entry-level roles and work your way up. The same principle applies to property ownership: you take small, strategic steps to reach your dream home.

Two of the best pieces of real estate advice I’ve received are:

- “Your first home is not your forever home.“

- “It’s not always about timing the market; it’s about time in the market“

Your first home will likely involve some compromises—that’s almost always a given. But time is your ally. The sooner you get into the market, the more opportunities you’ll have to build equity and work toward your ideal home. The journey begins with a single step.

What Do You Need to Buy a House (Get a Loan)

For most people, buying a house means getting a loan to buy a house. Getting approved for a loan generally requires two things:

1) A deposit (or equity from another property)

2) Borrowing capacity (your ability to service the loan)

I go through a brief lending 101 here but read this article for a more thorough explanation.

Having a Deposit/Equity

When lenders look to lend you money to buy a property, the general rule for residential lending is that you need a 20% deposit and they will lend you the remaining 80%.This is to ensure that your Loan-to-Value Ratio (LVR) is within acceptable limits and therefore reducing risk for the lender. The LVR is calculated simply as the amount of the loan divided by the value of your property.

This is important because the lender places a mortgage on your property, which basically gives them the legal right to sell your property to recoup their losses if you can’t repay your loan. If your LVR is too high, the risk is that if you are unable to pay your loan and they have to sell your house, they might not be able to sell it for a price that fully recoups the loan amount.

However, many lenders allow deposits as low as 10% (or less, depending on certain conditions and schemes but I’m not a financial advisor so will not go into any of that). In this scenario, the lender typically pays for something called Lender’s Mortgage Insurance (LMI) – insurance that the lender takes out to protect itself in case of default. This cost is passed onto you, the borrower, and can either be added to the loan amount or paid upfront.

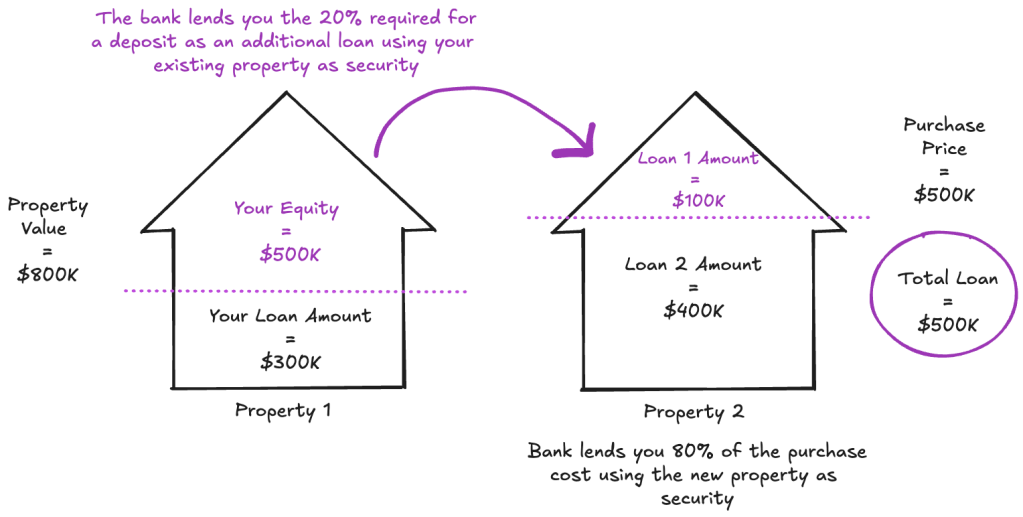

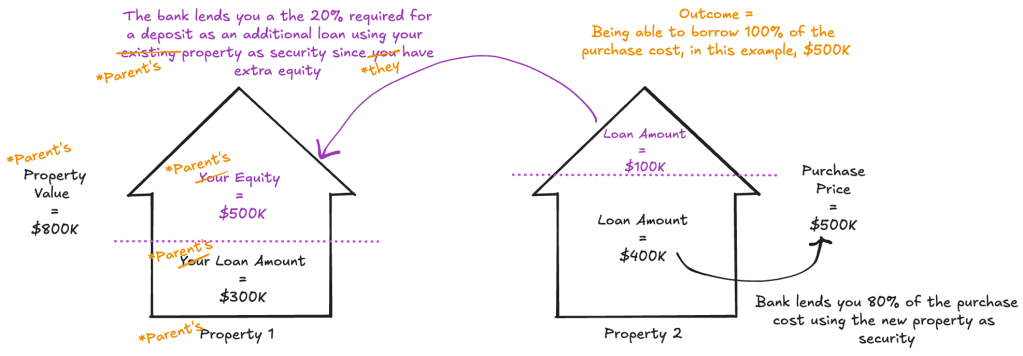

A deposit can come from cash savings or equity in another property. Equity is the difference between the market value of a property and the remaining loan balance. If you have a property with equity, lenders could let you borrow funds for a deposit of a home or investment purposes by using this equity. In short, instead of putting down a deposit, the lender can place an additional mortgage on your existing property and let you borrow more.

Using a Guarantor

As first-home buyers, we didn’t have any existing property to leverage and had saved up approximately $30K. While we didn’t have the “Bank of Mum and Dad” gifting us a deposit, my parents had equity in the only property they owned, the family home, and were willing to help us – not with a handout, but a hand up – by acting as guarantors.

A guarantor puts up a portion of their home’s equity as security for your loan, allowing you to borrow a higher amount, often with a smaller deposit. This strategy helped us to enter the property market sooner, borrowing up to 100% of the property’s value. The catch is, however, that we needed to be able to service the loan for 100% of the property’s purchase price (and my parents needed to be able to service the amount that they were guaranteeing(they don’t need to pay it, the loan is fully in our name, this is just a lending condition)). This brings us to the next part of the equation – borrowing capacity.

Borrowing Capacity

Borrowing capacity, also known as serviceability, refers to how much a lender is willing to loan you based on your financial position. Key factors that determine this include your income, liabilities, and expenses.

At the time, my partner was studying and working part-time, earning around $30K per year, while I was completing a graduate program, earning approximately $70K annually. While neither salary was extraordinary, together we had enough borrowing power to secure a loan.

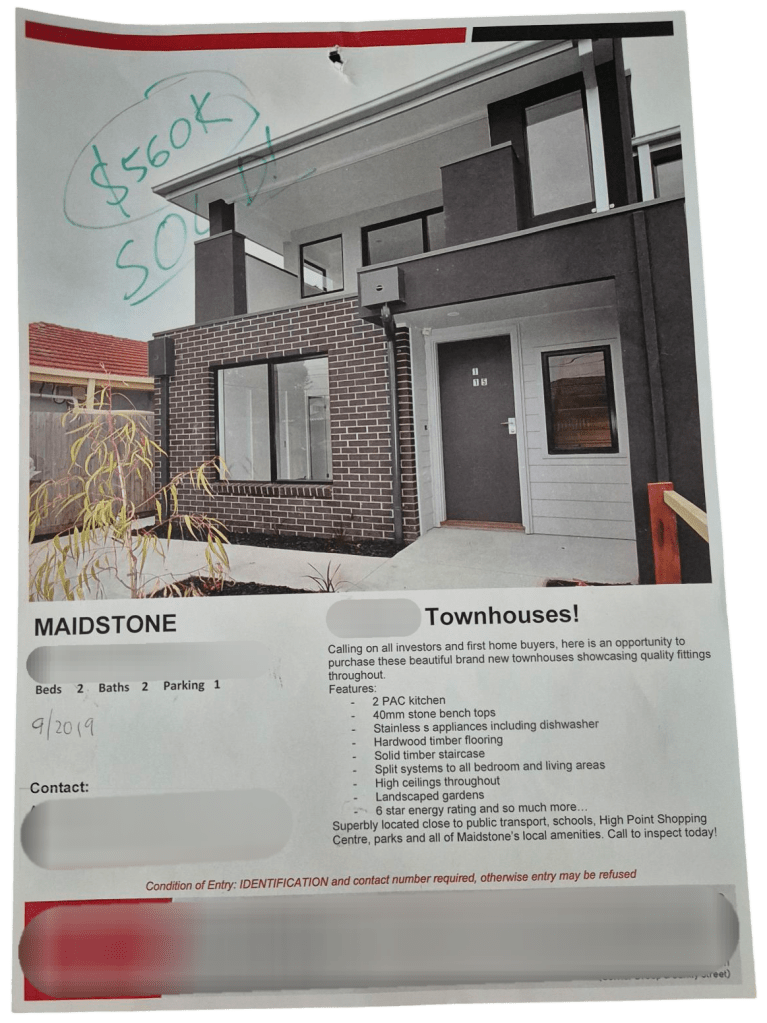

Our First Home

After numerous inspections and unsuccessful auction bids, we stumbled upon a two-bedroom, two-bathroom townhouse in Maidstone. Having grown up in Maidstone, I knew it was a great location for our lifestyle – close enough to the CBD and near our friends and family. We secured the property via private sale for $560K, and we were over the moon.

Fast forward about a year to 2021, and Australia’s property market was booming. Our townhouse, originally purchased for $560K had been revalued at $690K by the bank. This was a game changer because:

- We would remove my parents as guarantors because we had enough equity

- We had a little more equity to boost our deposit for another property

Recall earlier that typically lenders are comfortable to lend you up to an 80% LVR. Well with a loan just under $560K and a property valued at $690K – that basically left us with an 80% LVR. This eliminated the need for guarantors as we were within acceptable limits now. We also stretched our equity further and ‘topped-up’ our home loan to fund another property purchase.

Our First Investment Property

By this point, we had a bit of savings but needed a boost to get to $60K – the bare minimum to enter the investment property market based on my research at the time. I was obsessed with the goal of building an investment property portfolio to accelerate our path to financial freedom. While I knew that buying a first home to live in wasn’t the best move if we wanted to truly optimise our investment strategy, I also believe that there’s something to be said about balancing life and finance.

The $60K number came from the fact that I wanted to purchase a property value at approximately $300K. To do this, we were going to need a 10% deposit which is $30K, $5K set aside for purchase costs and a buffer, stamp duty at approximately $10K, and a buyer’s agent fee of $15K at the time. Where could we buy a property for $300K with $10K stamp duty? Interstate, regional. What is a buyer’s agent? I’ll explain that in detail in the next post.

To reach our $60K target, we increased our existing loan’s LVR to 85%, borrowing more from the bank. This meant we had to pay Lender’s Mortgage Insurance (LMI) – an added cost, but one I was willing to accept. Borrowing 90% for the investment property also triggered LMI, but I firmly believed in the principle:

“It’s not always about timing the market – it’s about time in the market”

Rather than wait the amount of time it would’ve taken for us to save a full 20% deposit, I ran the numbers and made an educated decision to move forward, accepting LMI as the cost of getting started sooner.

And with that, we had secured our first investment property. It was a 4 bedroom, 2 bathroom freestanding home in southern WA, on a 432m2 block purchased for $307K.

This absolute gem was revalued at $380K just 3 months after settlement, and we used that equity to purchase another investment property. Having this property in our portfolio was a blessing, and literally saved our behinds when it came to renovating our dream home and desperately needed the cash. After holding the property for 3 years, we were able to sell it for $583K. Paying LMI was well worth it.

Reflections

I acknowledge the advantage of having parents who were willing to act as guarantors, giving us a leg up into the property market. But that doesn’t discount the sacrifices and hard work it took to get there, because that part can’t be skipped. The reality is we had to put in the effort. The hours of work, the discipline to save, the countless books, podcasts, and educational content we consumed to make informed decisions were all part of the process. As the saying goes, “The only place where success comes before work is in the dictionary.”

We knew buying a dream $2M+ home wasn’t realistic straight away, but we could start the journey. We initially compromised on location and size, settling for a small townhouse in a good suburb rather than the inner-city or beachside, renovated home that we’d imagined. If we had prioritised space, we would’ve moved further out. At the time, given our income, keeping our first purchase around $500K – $600K also left some gas in the tank for us to borrow more as we knew we wanted to build an investment portfolio.

Was this the most optimal first step into property? I’m not sure, but it worked out. We were fortunate that our first home appreciated, providing us with equity, and that first investment property became a stepping stone toward our dream home. It played a crucial role in funding renovations for our current home and could have even been used to upgrade sooner. The reality is, we recognised that to get to our dream home, we needed to plan ahead and make some moves.

In the next few posts, I’ll break down our investment strategy, how lifestyle and income changes have impacted our journey, how we ended up buying interstate, what we learned about buyers agents, and how we found the right one. Plus, I’ll share where we’re headed next. Stay tuned.